What Is Retail Accounting and How Can Accounting For Retail Business Help You? - HostExpert

November 23, 2020

In that case, you may split the expenses of acquisition and initial inventory by the cost-to-retail ratio, which is calculated by dividing the product’s cost by the price you’re asking for. As a result, the phrase “retail accounting” is a little deceptive because it refers to an inventory management method rather than an accounting technique. Advanced InventoryIncluded in the Platinum and Diamond subscriptions only. Shipping subject to terms and conditions set forth by UPS, FedEx, and USPS.

- In this case, that would be $10,000 plus $2,500, which equals $12,500.

- The retail method is different from the other costing methods since it values the inventory based on the retail price instead of the cost to acquire them.

- It is accurate only when all pricing across the board is the same and all pricing changes occur at the same rate.

- Accounting automation tools play a key role in tax management by automating calculations, generating necessary tax reports, and providing timely reminders for tax deadlines.

- This empowers you to make informed decisions about your pricing strategy, inventory management, and overall financial health.

- First-in, first-out is a method used to count ending inventory costs that focus on cost flow.

- Stores may hold large quantities of many different products and sell a high volume of units each business day.

What does the accounting cycle look like for retail stores?

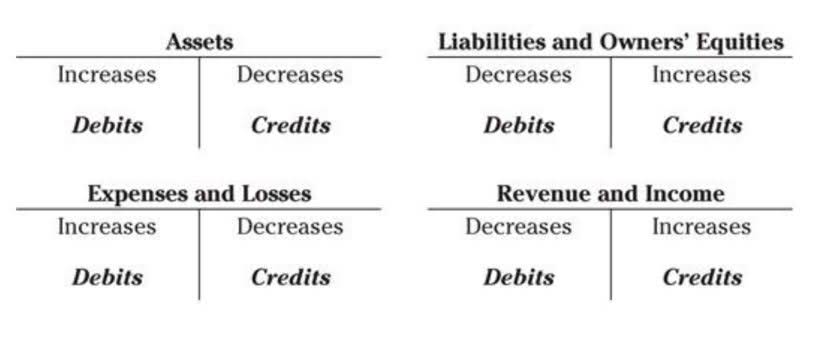

Read more for an overview of retail accounting, how it differs from other assets = liabilities + equity accounting forms, and the best way to get started. We assessed the upfront cost of the platform and the inclusions, such as the number of users. We also checked whether the software provides retail features in all its plans or only in the higher-tier options. In the ever-evolving landscape of retail, technology has become an indispensable partner for success. By embracing the right tools and software solutions, you can streamline operations, gain valuable insights, and unlock new levels of efficiency in your financial management. Every retail transaction, whether it involves sales, purchases, or expenses, needs to be accurately recorded.

Wave: Best for free accounting for invoice-based retail businesses

If you need a hand in creating a custom retail solution for your business, contact us, and our experts will help you streamline your accounting with the latest technology. Furthermore, Wave earned a very low score for customer support because the only support options available in the free plan are a chatbot and self-help guides. You’ll retail accounting get access to live chat and email support if you purchase an add-on in the free tier or upgrade to the paid subscription.

Wholesale business

- That said, if you operate multiple retail stores or locations, Enterprise is worth a try.

- Retail businesses present distinct difficulties, especially when it comes to retail accounting.

- If you’re choosing an accounting method for your retail business, there are also some advantages and disadvantages.

- This popular method estimates the cost of ending inventory based on the average cost of goods sold throughout a specific period.

- More specifically, in retail accounting, you’ve got to value all of your inventory at retail value and then subtract your sales to estimate your remaining inventory.

- However, it’s handy to compare it to commonly used forms of accounting.

Throughout this blog post, we’ve embarked on a journey to demystify retail accounting. We’ve explored the fundamental principles, delved into retail-specific terms, and unveiled the stories hidden within financial statements. We’ve tackled the challenges of inventory management and cost control, while uncovering the power of technology in empowering your financial management. The retail method of accounting is a popular valuation strategy for retail stores primarily because of its simplicity. If you use a flat markup rate across all products, then you can calculate your ending inventory cost without counting it. An inventory system provides retail-based businesses a comprehensive account of available items and the monetary value of these inventory items.

This includes receipts, invoices, and any other relevant documentation. Point-of-sale (POS) systems can https://www.bookstime.com/ automate this process by capturing transaction details, reducing the chances of manual errors. The last-in-first-out (LIFO) cost flow assumption is the opposite of the FIFO method. It assumes that the last units you purchase or produce are the first ones you sell. Apply for financing, track your business cashflow, and more with a single lendio account.

It has both FIFO and LIFO inventory costing methods and the essential features needed by most retailers, like automatic accounting for COGS and real-time inventory tracking. QuickBooks Desktop Enterprise Retail Edition has the most advanced inventory features among the software on our list. Some of the advanced inventory features you’ll find include barcode scanning, advanced pricing rules, lot and serial number tracking, and multilocation inventory management. It can also track sales taxes and provide ample integrations with ecommerce and POS systems. Furthermore, the Retail Edition provides customized reports for retailers, including sales by product/service summary, item price list, and sales by customer type reports.

-

Gamble Fortunate Haunter casino no deposit bonus Eurogrand 25 free spins slots online free of charge February 18, 2025 No Comments

-

Gamble 100 percent free Harbors On the internet: 5500+ Demonstration 50 000 Pyramid no deposit free spins Slot machines February 18, 2025 No Comments

-

ten Greatest A real income Online free slots uk 88 fortunes slots Sites out of 2025 February 18, 2025 No Comments