How to Outsource Your Bookkeeping Bench Accounting - HostExpert

June 30, 2021

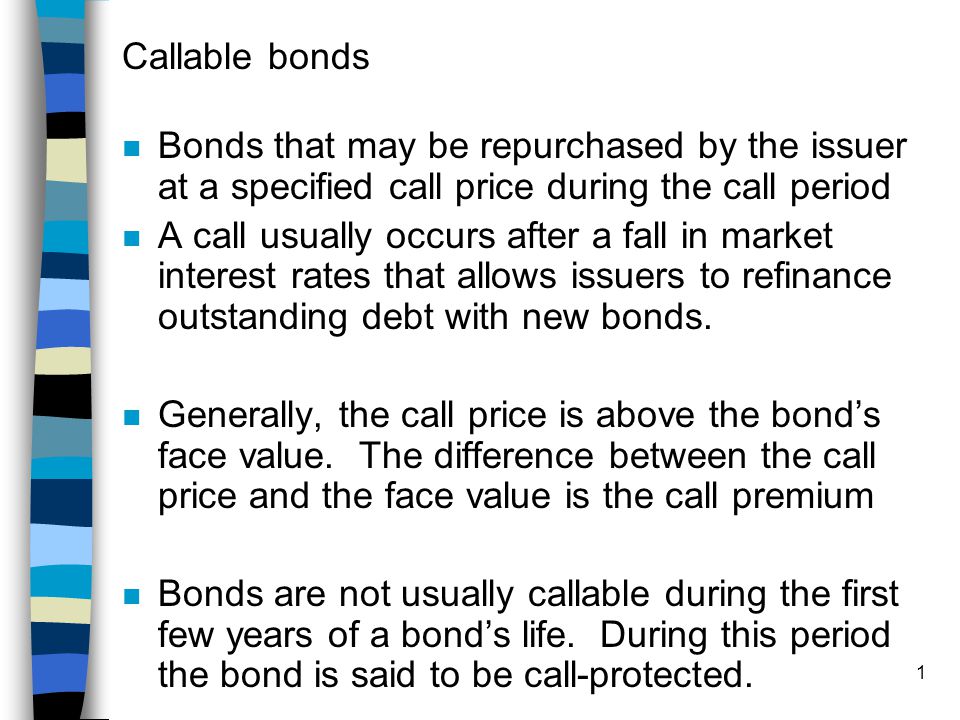

These tools can be helpful for automatically importing transactions from your bank accounts and payment processors like Stripe. Virtual accounting services on the other hand rely on accountants to keep their business going therefore they make sure they hire the best and most qualified accountants. This ensures that all your accounts are maintained perfectly with zero errors. If you are just getting started with your business and want to have a virtual bookkeeping service right from the start, make sure you also choose a reliable bank account for small businesses. They support a wide variety of accounting software, unlike most other service providers who support only QuickBooks and Xero.

How to outsource your accounting

You might also not be able to migrate it to another service provider in the future. But you can link with major payroll processors and all major payment processors. If you have any questions, you can get in touch with your bookkeeper from Bench’s platform or their app and they generally reply in a day. You can also contact them by phone on weekdays making your accounting team very accessible. You will have a dedicated bookkeeper who will work closely with you to keep your bookkeeping up-to-date. Bench uses their proprietary platform so you can access all your reports from their dashboard.

- You will have a dedicated bookkeeper who will work closely with you to keep your bookkeeping up-to-date.

- Forbes Advisor selected these services based on their service options, pricing, customer service, reputation and more.

- A bookkeeping service can help you stay organized and on top of your finances.

- The best virtual accounting software integrates with the best payroll software and brings them together with your accounting.

- Oftentimes, a bookkeeping service is essential for business growth and health.

- While there are many options available out there, choosing the best-outsourced accounting service can be challenging as you will be hiring people to take care of your company’s finances.

Pay your team

These kinds of steps can give you peace of mind and help ensure you avoid any costly slip-ups. Accounts receivable (AR) and accounts payable (AP) are essential accounting functions for any business. They ensure the timely collection of payments from your customers for products or services sold (AR), and management of the money you owe to vendors (AP).

Not only could such errors land you in hot water with the IRS, but they could also contribute to bad business decisions that impact your financial future. Reduce costs, manage taxes, administer benefits, and stay globally compliant when you consolidate payroll with Remote. Data security is a serious concern for any business, as breaches can lead to financial losses, legal issues, and reputational damage. As mentioned, it’s crucial to take relevant precautions when sharing sensitive data with your provider.

If you only need periodic help, pay as you go for $49 per month plus $125 per hour for support. Otherwise, monthly pricing starts at $399 and weekly pricing starts at $549 per month. However, with hundreds of options, it can be daunting to sort through them all and find the best service for your business. We’ve analyzed the best bookkeeping services to help you find the right solution quickly and easily. Forbes Advisor selected these services based on their service options, pricing, customer service, reputation and more. The virtual bookkeeping providers above might be our favorite—but if they don’t quite prepaid expenses fit your needs, we understand completely.

Best Virtual and Outsourced Accounting Services in 2024

On top of that, you need the data used in bookkeeping to file your taxes accurately. For additional features, these were elements that fell into the “nice-to-have” category that not all software providers offered, either as part of their regular plan or as a paid add-on. Second, freelancers are usually contracted workers who are hired to help balance your books, while firms are dedicated accounting companies that solely focus on that goal. Having all of your bookkeeping together throughout the year will make tax season much easier. Up-to-date reports will be provided monthly throughout the bookkeeping process, giving you a good idea of how much you’ll please honor my power of attorney law office owe when tax season hits.

Seek feedback from other businesses, and inquire about the provider’s responsiveness, accuracy, and overall reliability. Clear communication is key, so choose a bookkeeper who can explain financial concepts in a way that you understand. Technology allows outsourced financial services to scale easily, accommodating changes in the volume of financial transactions without a proportional increase in costs.

Virtual accounting is a service provided by virtual accounting firms where qualified and experienced professionals provide accounting services remotely. They perform 1 period non-manufacturing costs are classified into two categories all the activities for a business that an in-house accountant provides. When compared with in-house accounting, virtual accounting is much more flexible, efficient and saves time as well as money.

Outsourcing allows for scalability, making it easier to adjust the level of bookkeeping services based on the business’s changing needs. Outsourcing bookkeeping services doesn’t entail a one-size-fits-all approach; rather, it offers a range of specialized services tailored to meet diverse business needs. If you want your business to save time and money, then you should consider hiring a bookkeeping service. A bookkeeping service can help you stay organized and on top of your finances. Bookkeeper360 is best for businesses that occasionally need bookkeeping services as well as those that want integrations with third-party tools.

Choosing the suitable blend of these outsourced bookkeeping services relies on your business’s scope and nature. It provides a tailored, adaptable solution for efficient financial management. Outsourcing bookkeeping services offers numerous benefits, making it a strategic choice for businesses.

-

-

1xbet Live Casino 💰 Bonus up to 10000 Rupees 💰 Play Live Roulette Online November 21, 2024 No Comments

-

Kometa Casino Russia 💰 Casino Welcome Bonus 💰 Play Spin and Win Slot Online November 21, 2024 No Comments